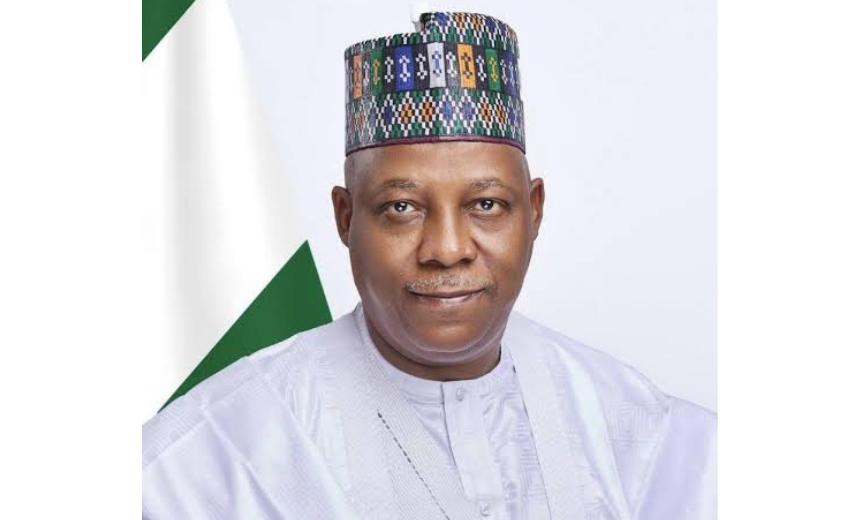

Vice President Kashim Shettima has restated the commitment of the President Bola Ahmed Tinubu’s administration to revamping the nation’s tax system without overburdening Nigerians.

He said the fundamental motive of the administration is not to increase the tax burden on Nigerians, but to improve the efficiency of tax collection.

Speaking on Thursday when he received a delegation from the Chartered Institute of Taxation of Nigeria (CITN) at the Presidential Villa, VP Shettima noted that no Nigerian is pleased with the illegal tax collections happening across the entire country by non-state actors.

Soliciting CITN’s insights on attracting Foreign Direct Investments (FDIs) through competitive company tax rates, Shettima said, the focus of the President Tinubu administration is not to increase the tax burden on Nigerians but to improve the efficiency of tax collection. “That is our fundamental motive.”

The Vice President stressed the importance of collaborating with the CITN to adopt global best practices in tax administration, pointing out that “knowledge is not something you can buy in the market square; you have to earn it”.

CITN President, Samuel Agbeluyi, commended the Federal Government’s efforts to address the needs of Nigerians, citing the recent suspension of the Cyber Security Levy as a prime example.

He applauded the administration’s initiatives, including unifying exchange rates, attracting foreign investments, establishing the Presidential Committee on Fiscal Policy and Tax Reforms, as well as deploying monetary policy measures to stabilise the Naira, combat inflation, and recapitalize banks.

Agbeluyi outlined the CITN’s multi-pronged goals, chief among which is forging a strategic partnership with the government to ensure the smooth implementation of the fiscal policy committee’s recommendations.

(Editor: Ken Eseni)