The Central Bank of Nigeria, CBN says interest rates on its facilities through participating Other Financial Institutions, OFIs is now down from 9% to 5% per annum for one year effective March 1, 2020.

The apex bank in a statement said the decision is part of its continued effort to mitigate the impact of the Coronavirus pandemic on households, businesses and regulated institutions.

The Bank, in a circular signed by the Director, Financial Policy and Regulation Department, Kevin Amugo, and issued on Wednesday, May 27, 2020 in Abuja, also announced that CBN intervention facilities obtained through participating OFIs incl Microfinance Bankjs, Primary Mortgage Banks, and Institutions, among others will be given a further one-year moratorium on all principal repayments, also effective March 1, 2020.

According to the circular, OFIs have also been granted leave to consider temporary and time limited restructuring of the tenor and loan terms for households and businesses affected by COVID-19, subject to the recently issued guidelines for restructuring affected credit facilities.

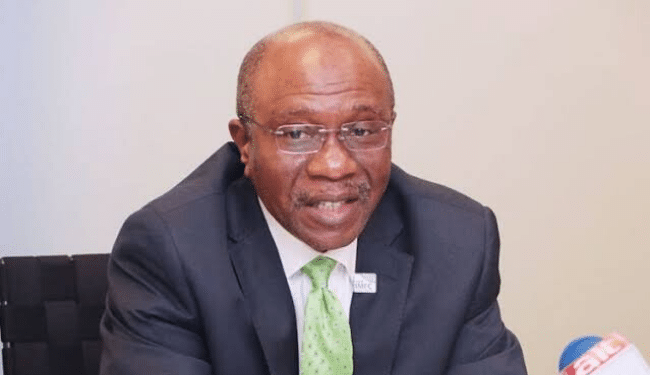

Explaining the decision of the apex bank, the Director, Corporate Communications Department, Isaac Okorafor said that the CBN would also continue to monitor developments and implement appropriate measures to safeguard financial stability and support stakeholders impacted by the Covid-19 pandemic.

Meanwhile, the Monetary Policy Committee, MPC meeting of the CBN for the month of May 2020, holds on Thursday, May 28, 2020.

(Editor: Terverr Tyav)