It is now unlawful for officers of the Nigerian Customs Service to demand and collect import duty and other related charges from anyone in respect of goods or personal effects found in their baggage provided that such are not meant for sale, barter or exchange.

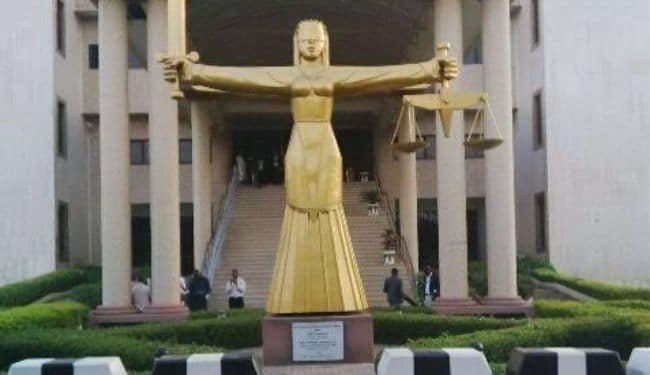

This was the decision of the Federal High Court, Abuja in a suit filed by Tunde Adejumo on behalf of a Senior Advocate of Nigeria, Kehinde Ogunwumiju challenging the infringement on his right to personal properties.

Also Read: Governor Ayade kicks against building Coronavirus isolation centres – Ayade

The plaintiff had approached the Court seeking a declaration that in view of the provisions of Section 8 of the Customs, Excise Tariff Act and the 2nd Schedule to the Customs Excise Tariff Act, it is unlawful for officers of the Nigerian Customs Service to demand and collect import duty and other related charges from any Nigerians in respect of their personal effects.

Ogunwumiju alleged that upon his return to Nigeria on the 24th of June, 2019, the Nigerian Customs Service during baggage search compelled him to pay duties on a computer bag meant for his personal use.

Justice John Tsoho in his judgment held that the Customs has failed to establish credible evidence that such was meant for sale, exchange or barter therefore import duty and other related charges in respect of such personal effect are unlawful, null and void.

The Court also ordered that all duty paid be refunded to the plaintiff and awarded the sum of N5 million as exemplary damages against Customs.

(Editor: Terverr Tyav)